The world is digital now, and with that comes ease. This is where Swapitor comes into play. Swapitor is a website that connects its users to education firms.

Through Swapitor interested persons can start learning about finance. Swapitor is here to help spread the word about access to finance and investment education. Swapitor does all this for free.

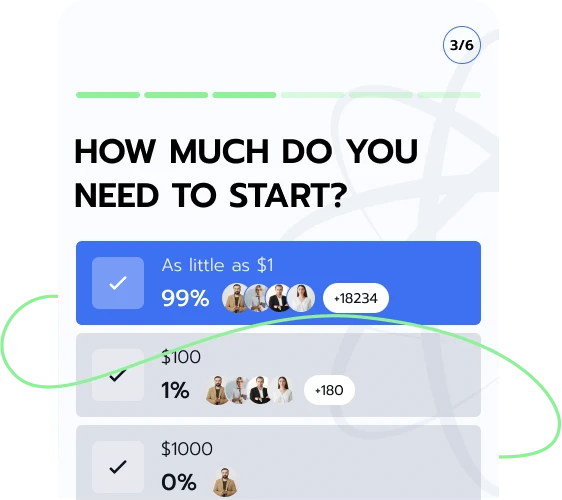

Getting registered on Swapitor is easy and also free. Remember, Swapitor is all about giving everyone, even the most unlikely, a chance to learn about investments. How? By connecting them to suitable investment education firms.

Swapitor wants to spread the availability of financial knowledge and to do so, there have to be no obstacles. Swapitor is easy to understand and access. So, for those interested, registration is easy with zero language obstacles. Register on Swapitor and get connected to an education firm.

Guess what? Swapitor is a hundred percent free to use. Anyone seeking access to investment education firms can register for free on Swapitor.

At zero cost, Swapitor has enabled its users to focus on acquiring knowledge and not bother about certain fees.

Swapitor is a solution. As a result, Swapitor has a plethora of cultures represented by the people who visit and are registered on the site.

Swapitor understands the issue that might be a result of language differences. But we have it sorted out! How? The website is available in multiple languages to offer our services to individuals anywhere in the world.

To begin, interested people have to register on Swapitor. Also, registering on Swapitor, as mentioned previously, is easy. Registration requires details such as name, email, and phone number.

After filling in contact details, users are then connected to a financial education firm. The information the Swapitor users fill out is used to link them with an education firm.

When an Swapitor user connects with an education firm, they get to converse with a representative. The representative and the new user then discuss how to tailor the study plan.

Interest rates have a significant impact on the choices and tactics made about investments. They may affect the cost of borrowing, the returns on different asset classes, and the state of the economy. All these may have an impact on investment decisions. Low interest rates may also make borrowing more affordable, which motivates people and companies to increase their spending and investment. And when interest rates are high, the opposite is true. Learn more via Swapitor.

Despite the fact that it may take a minimum of a year for an interest rate adjustment to have a significant effect on the economy, the reaction of the stock market to a shift is frequently quicker.

Inflation is an economy-wide, continuous tendency of rising prices from year to year. The rate of inflation is a measure of how quickly prices rise over time and how quickly investments may lose their true worth. One important element that could have a big impact on investment portfolios is inflation. Swapitor is here to connect people to firms where they can learn more about Inflation. More on inflation follows:

Liquid assets are affected by inflation in the same way as other asset classes. This is even though the appreciation of liquid assets may be typically slower.

Over time, inflation may reduce the purchasing power of funds. Therefore, investors may have to take proactive steps to reduce its effects on their portfolios.

Securities Protected Against Inflation

Investments that have a foot in inflation-protected securities may be one way to reduce inflation. It is believed that through this, assets can be secured.

Having Real Assets

Real assets, like infrastructure, commodities, and real estate, may frequently act as a built-in safeguard against inflation. They may see a gain in value as inflation rises. Including real assets in an investing portfolio may shield financial assets like stocks from the consequences of inflation.

Solid Commodities

Agricultural items, gold, silver, oil, and other commodities may also do well during periods of inflation. The cost of resources and raw materials typically rises when inflation rises.

Gold, in particular, is frequently seen as a safe-haven asset during inflationary times. This is because it maintains its value even when other currencies lose purchasing power. These commodities are very crucial in times of inflation. Interested persons can learn more about commodities in inflation via Swapitor.

Inflation primarily surfaces when the demand for an item or service exceeds supply. Governments may be able to control inflation through the implementation of wage and price controls.

High Net Worth Individuals (HNIs) have an elite status in the financial world. For high-net-worth individuals, braving finance involves more than just standard market strategies. This may essentially be because of their goal, which most likely is to preserve funds. Register on Swapitor and get connected to educators to learn more about this.

High-net-worth investment entails distributing assets in a calculated manner to pursue long-term financial objectives. It may also safeguard one's legacy. They can afford to use advanced strategies because of their higher capital base. This may also preserve funds and facilitate returns.

A substantial portion of these portfolios are made up of alternative investments, including real estate, hedge funds, and private equity. Frequently, these tactics combine conventional investments with non-traditional assets and personalized financial planning.

Lending funds to private businesses or people is known as private debt investing. This is done outside of conventional financial organizations such as banks. It has developed in popularity as an asset class among high-net-worth individuals and institutional investors. Their goal is to seek yields that are higher than those found in the public debt markets. This is an interesting financial concept, and Swapitor is here to connect users to educators to learn more about the subject.

The majority of private debt loans have fluctuating rates. They may provide investors with some sort of defense against their returns being eaten away by inflation. Unlike fixed-rate bonds, private debt investments may maintain their value in an environment of rising interest rates and higher inflation. There are various types of private debt investments, and they include;

This entails making direct loans to firms, typically middle-market firms, who might find it difficult to access the public debt markets. Direct lending could be in various forms, such as long-term loans.

Mezzanine finance is a combination of equity and debt. Usually, it entails lending funds to a business along with an equity boost.

Investors buy the debt of businesses that are bankrupt or having financial problems. The intention is to purchase this debt and restructure it to try for gains. Learn more after using Swapitor to connect with educators.

Developers and property owners may obtain loans from investors in real estate debt to finance real estate initiatives. These loans may be less hazardous than other types of personal debt. This is because they could be backed by the actual property. Get connected to education firms on Swapitor to learn more.

A broad definition of "security" includes a variety of investments. This covers interests in limited partnerships, stocks, bonds, notes, debentures, oil and gas interests, and investment contracts. Security is a financial investment made in a company with the hope of making gains.

A security is not currency, a check, a bill of exchange or, a draft, or even a letter of credit. Rather, security is simply a form of investment. Learn more after signing up for Swapitor for free and connecting with education firms.

Peer-to-peer, or P2P, lending, enables people to borrow funds directly from other people. By doing this, using a bank or other financial institution may no longer be necessary. It has been a far more popular alternative finance option in recent years.

Crowd lending and "social lending" are other names for peer-to-peer lending. P2P borrowers look for a cheaper interest rate than they could acquire at a regular bank or an alternative to them. P2P lending platforms may allow direct communication between individual lenders and borrowers. Every platform determines its own terms and prices.

Interested in knowing more about peer-to-peer? Swapitor can connect anyone with a desire to learn with a fitting investment education firm. How? Simply sign up on the website for free!

Credit ratings provide an estimation of the degree of risk associated with lending funds to a company or other organization. Government agencies, including the federal, state, and local governments, are also included. In essence, the credit rating shows how likely it is that an issuer will default because of bankruptcy. Sign up on Swapitor for free and get connected to education firms to learn more.

The determination of the cost of borrowing for a government, business, or financial institution is one of the main purposes of credit ratings. Because of this, credit ratings may play a critical role in evaluating the viability of projects and capital investments. Registering on Swapitor positions one to learn more.

Investors may make decisions more easily by using credit ratings. They may offer a rapid assessment of a borrower's credibility. Instead of performing their own in-depth credit investigation, investors frequently use credit ratings to evaluate risk. Get linked to education firms and learn more via Swapitor.

Credit rating declines can serve as warning signs for investors during times of market stress or economic downturns. This may aid in their portfolio management. Learn more about this after signing up on Swapitor.

Having an excellent credit rating is frequently necessary for businesses and governments looking to raise funds on international markets.

Regulators mandate that many financial institutions maintain specific capital adequacy levels. Holding assets that satisfy particular credit rating requirements is required for this.

The reputation of a business among stakeholders, including consumers and shareholders, can also be impacted by credit ratings.

By acting as a link between educators and students, Swapitor offers an organized, approachable setting that supports investment education. All the topics listed above are but a few matters in the discipline of finance and investment.

Swapitor is here to aid users in starting their learning journey in finance via education firms. Register for free on Swapitor and connect with a fitting educator.

| 🤖 Entry Fee | No entrance fee |

| 💰 Incurred Costs | Free of any charges |

| 📋 Process of Joining | Registration is streamlined and fast |

| 📊 Subjects Covered | Education on Crypto assets, Forex markets, and Investment strategies |

| 🌎 Eligible Countries | Almost all countries are supported except the US |